In 2025, renewable energy is more than just an eco-friendly trend—it’s a smart financial move for homeowners. Solar panels, wind energy systems, and other renewable solutions can cut monthly utility bills, boost property value, and even generate additional income. But how do you maximize your return on investment (ROI) when installing renewable power systems at home? Let’s break it down step by step.

1. Evaluate Your Energy Consumption

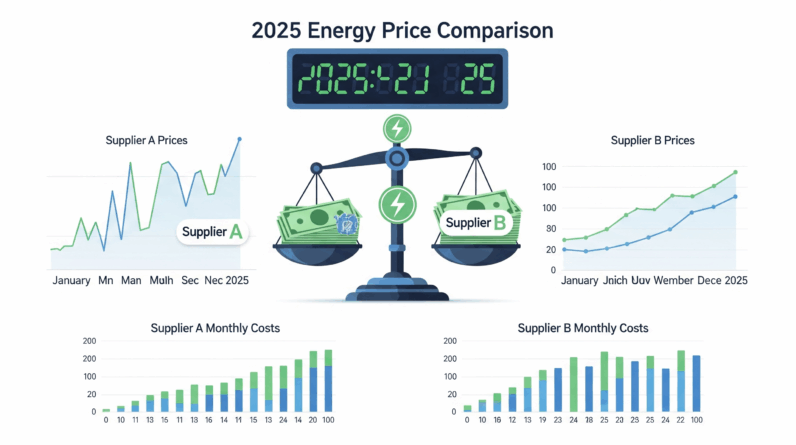

Before jumping into solar or other renewables, analyze your household’s current energy usage. Collect the last 12 months of electricity bills to identify average consumption patterns. Knowing your baseline helps you choose the right system size and avoid overspending on unnecessary capacity.

2. Understand Local Incentives and Tax Credits

Government incentives remain one of the biggest ROI drivers in 2025. In the U.S., the federal solar investment tax credit (ITC) allows homeowners to deduct a percentage of installation costs from their taxes. Many states also offer rebates, performance-based incentives, or net metering programs where you earn credit for sending excess electricity back to the grid. Taking advantage of these programs can reduce payback time by several years.

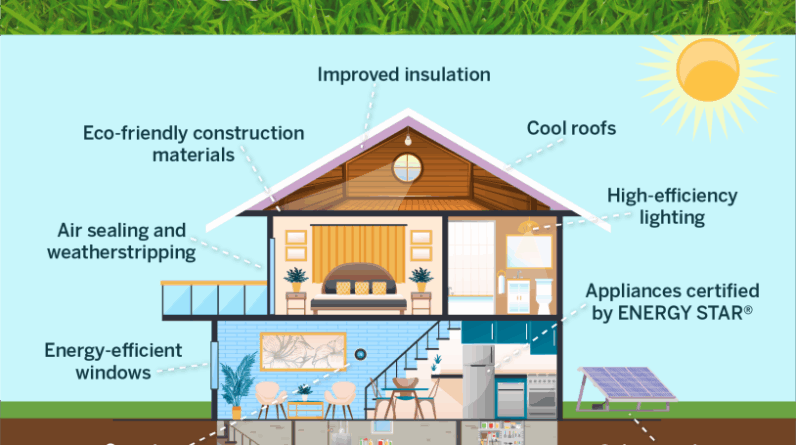

3. Choose the Right Technology

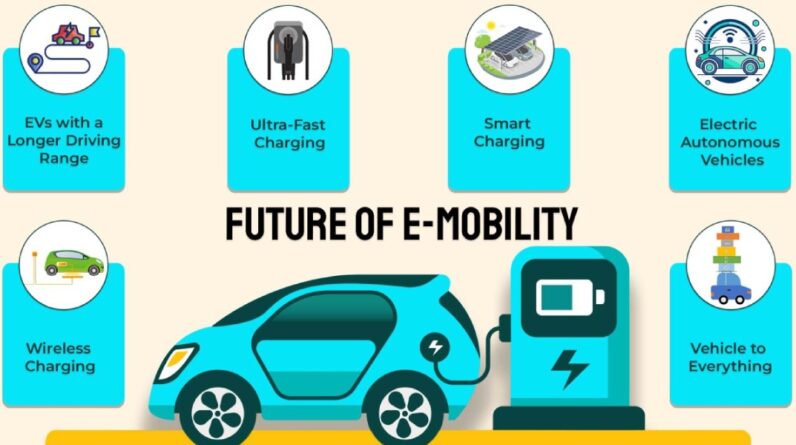

Not all solar panels are created equal. High-efficiency panels may cost more upfront but often generate greater savings over time. For windy areas, small-scale residential wind turbines can complement solar production. Hybrid systems that combine solar, storage batteries, and smart inverters often deliver the best balance between reliability and ROI.

4. Consider Battery Storage

Energy storage is becoming essential. With a home battery, you can store excess daytime solar power for use at night or during outages. While batteries increase installation costs, they also protect against rising utility rates and provide energy independence. In many cases, storage can double the financial benefits of a solar system.

5. Factor in Maintenance and Longevity

Renewable energy systems are long-term investments. Most solar panels have warranties of 20–25 years and require minimal maintenance beyond occasional cleaning. Budgeting for inverter replacement after 10–15 years is wise. Keeping your system well-maintained ensures consistent performance and stronger ROI.

6. Work with Trusted Installers

The installer you choose can make or break your investment. Look for companies with strong track records, certified technicians, and transparent contracts. Reliable installers help you optimize system design, secure incentives, and avoid costly mistakes.

7. Calculate Payback Period and Lifetime Savings

A typical residential solar installation in 2025 can pay for itself in 6–9 years, depending on location and incentives. After the break-even point, most homeowners enjoy thousands of dollars in savings each year. When framed as a 25-year investment, the lifetime ROI of solar and renewable power often outperforms traditional investments like bonds or savings accounts.

Final Thoughts

For homeowners, renewable energy isn’t just about saving the planet—it’s about creating long-term financial stability. By carefully analyzing energy usage, leveraging incentives, choosing the right technology, and working with trustworthy professionals, you can maximize your ROI from solar and renewable power. The sooner you make the switch, the faster you’ll enjoy the benefits of lower bills, higher property value, and energy independence.